Top 5 Leading FinTech Companies in Nigeria

With dynamic competitive market globally, FinTech has been bustling in the banking sector since it's debut. With a secure and easy payment process, this innovative technology is set to take the financial sector by storm.

FinTech or fintech is short for Financial Technology. According to a tech buzzword glossary by the largest professional service network- Deloitte.

“FinTech is a term that describes the emerging tech industry that aims to modernize, improve and automate the delivery of financial services and achieves this through the use of modern software and infrastructure with solutions that competes with traditional methods to deliver financial solutions. It includes a vast range of products, technologies and business models that are changing the financial service industry across the globe.”

FinTech in Nigeria

FinTech encompasses everything from mobile payments, crowdfunding platforms, cryptocurrencies, and personal services which are extensively used fintech business models in Nigeria.

With the bustling Banking practices in Nigeria, and value pools spanning over $9 billion, fintech is fast becoming an alluring industry to delve into. Though still in its budding days, the fintech sector in Nigeria is expected to make a full bloom in no time — A report in 2020 noted-

“ A youthful population, increasing smartphone penetration, and a focused regulatory drive to increase financial inclusion and cashless payments, are combining to create the perfect recipe for a thriving fintech sector.”

- mckinsey.

Currently, Nigeria has over 200 emerging and existing FinTech companies. Here are top 5 companies leading the Nigerian FinTech Industry.

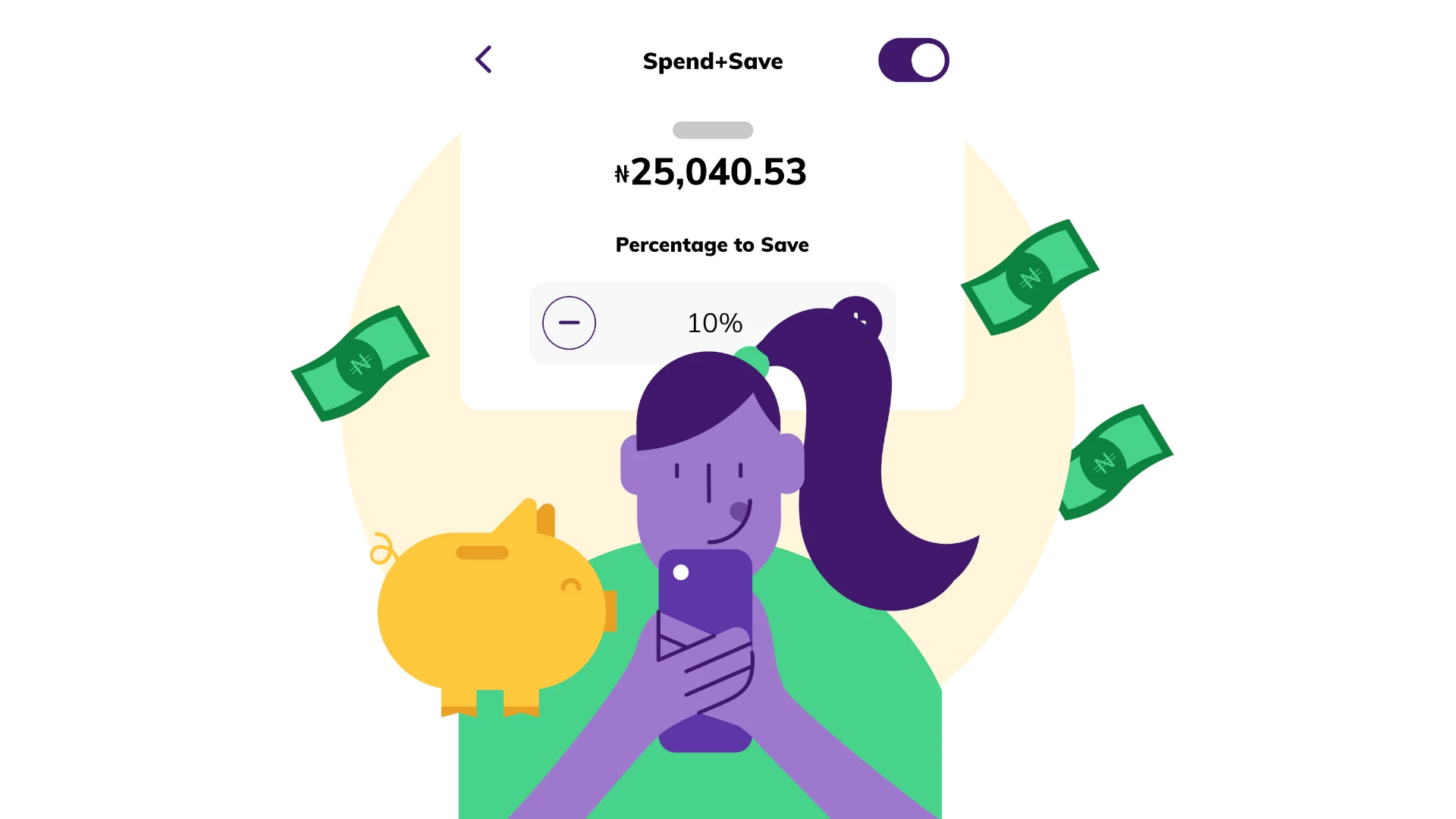

PiggyVest

PiggyVest is one of the most considerable secure online savings and investment platforms managed by AIICO Capital. The company boasts a staggering 3 million+ customers since its release in 2016. With PiggyVest, you get to save money at lower interest rates in comparison to the higher rates of local banks. It offers plans that help you build your savings be it fixed, automated, goal-oriented savings, or flexible savings. It provides earnings of 8-13% interest on savings and up to 25% on investments, making it attractive to its target market.

Related: 5 best virtual banks in Nigeria

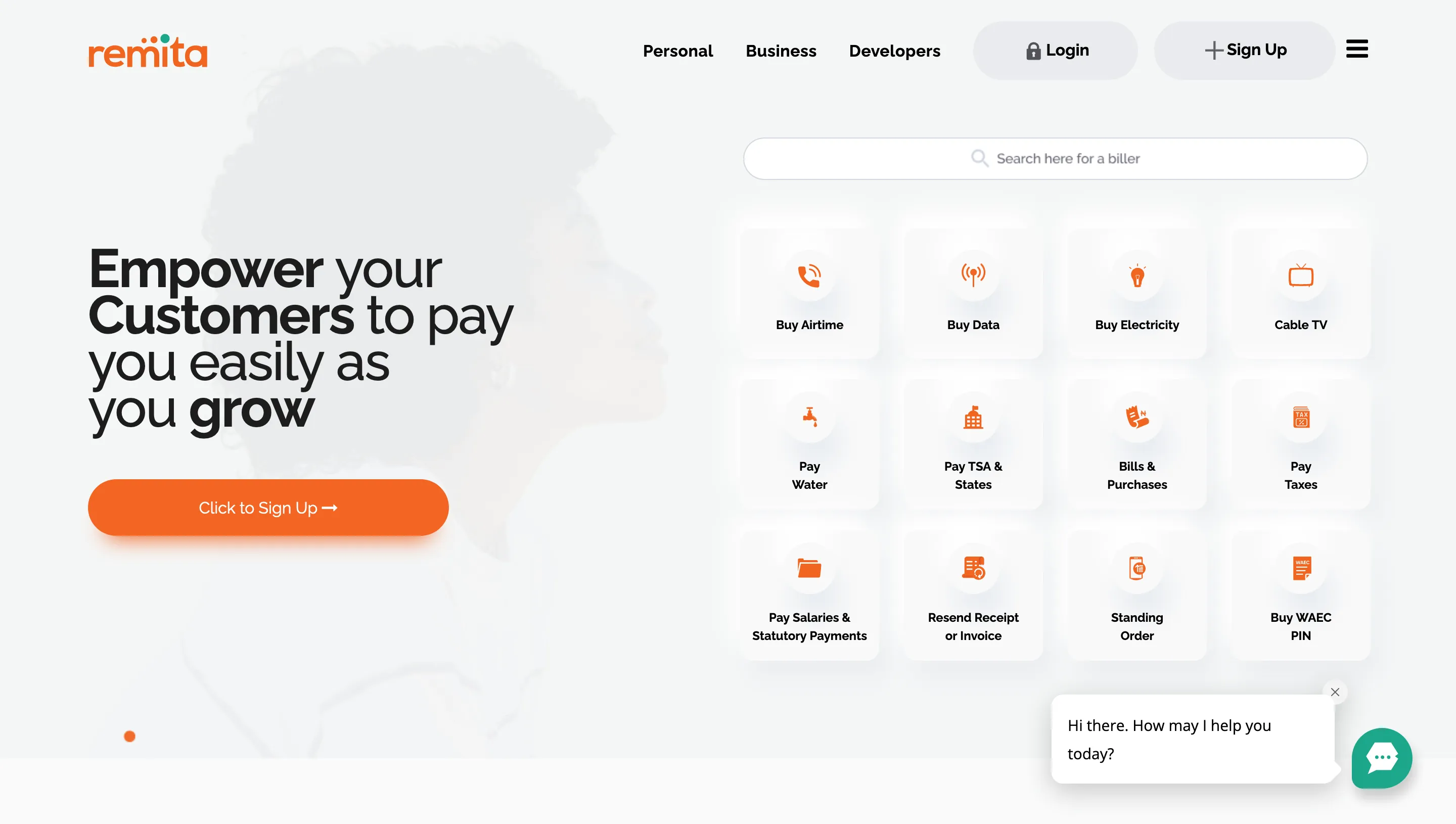

Remita

Remita is a popular electronic payment platform in use in Nigeria. It is utilized by businesses and individuals (private or government-owned), enabling you to make a secure payment to a biller and easily retrieve your payment receipts/invoices. You can select the option to sign up as a biller or pay other billers. What makes Remita quite exciting- taxes, levies and tariffs can be paid directly to the government without fear of missing deadlines. Also, weekends and holidays pose no obstacle to making payments on this platform.

See also: How to Make Money Online in Nigeria as a Student

Jumia Pay

JumiaPay claims to be the most secure, safe, and convenient online shopping payment method and provides free bills payment when you make payments on your utility bills. JumiaPay is a transfer payment method available on Jumia online shopping market. Once you sign in to the JumiaPay wallet on JumiaPay, it is easy to make payments for various offerings- airtime, TV subscriptions, bank- transfers, and more.

Kuda

Founded in 2016, with over 1.4million users registered, Kuda has been intentionally leveraging the internet as a marketing tool through online adverts to its target market. It is the pioneer of mobile-only banking and the first to be licensed by CBN. Nicknamed the African challenger bank, it may interest you to know, that with Kuda Bank, users can have a new banking experience with free card maintenance fees, free transfers and more.

Opay

Opay, an acronym for Official Payment Corporation, is a mobile money service trusted by over 8 million active users. It enables users to pay bills, make fast and secure transfers, receive money, and offline banking services.

“OPay gives you the freedom to make quick and easy payments, spend smart, and save more”

— OPay

The rise of the innovative technology-Fintech in Nigeria makes it easier to take out loans, transfer money or pay bills using just your mobile phone. With FinTech we can leverage digital technologies at our own convenience and even in the comfort of our homes.